- Quickbooks direct deposit form how to#

- Quickbooks direct deposit form update#

- Quickbooks direct deposit form full#

- Quickbooks direct deposit form verification#

- Quickbooks direct deposit form download#

Your completed direct deposit form can be viewed at any time by tapping Get Direct Deposit Form from the Money tab and selecting View Previous Form. You'll be able to produce all the federal payroll tax forms you need.

Select Email Form and enter the recipient address before tapping send. Fill out your employer information, the amount you would like to be deposited from each paycheck, and provide your signature. Provide the account and routing number when prompted for a bank account during direct deposit setup. Use the options to copy your account and routing numbers. Tap the routing and account number below your balance. Tap the Money tab on your Cash App home screen. If you do not receive your direct deposit account details immediately after ordering, you may need to wait until your physical Cash Card arrives and activate it. Once enabled, you can receive up to $25,000 per direct deposit, and up to $50,000 in a 24-hour period. Still Stuck? Call +1-(818) 900-9884 Chat Live to the Customer Care Executive.You can order a Cash Card to enable direct deposits.

If you need to pay your employees but have not completed the bank account verification and activation steps, you will need to issue paper checks. You’ll need to activate the new bank account if you desire your next Direct Deposit payroll to debit from it. ( Note: Faxed documents take longer to process.)

Method 1 (Recommended) Email the form to Method 2 Fax it to (818.900.9884). You have the choice to download the form and submit it to QuickBookExperts using one of the following methods:

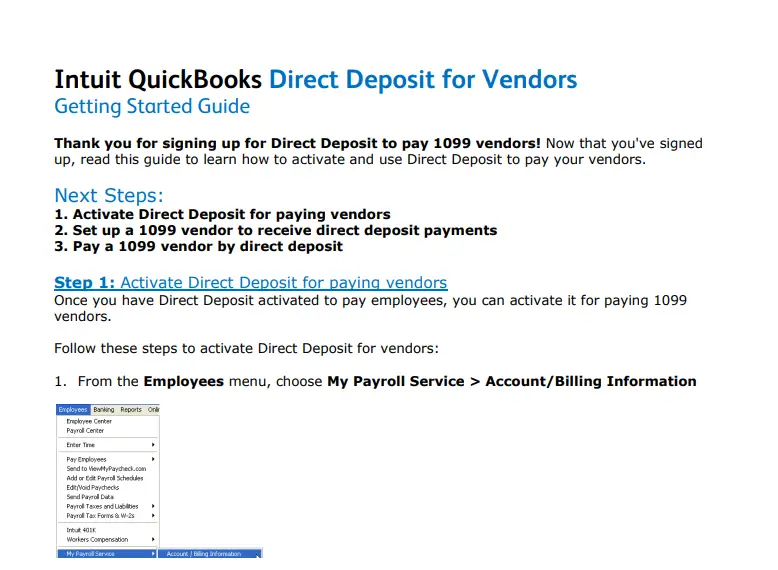

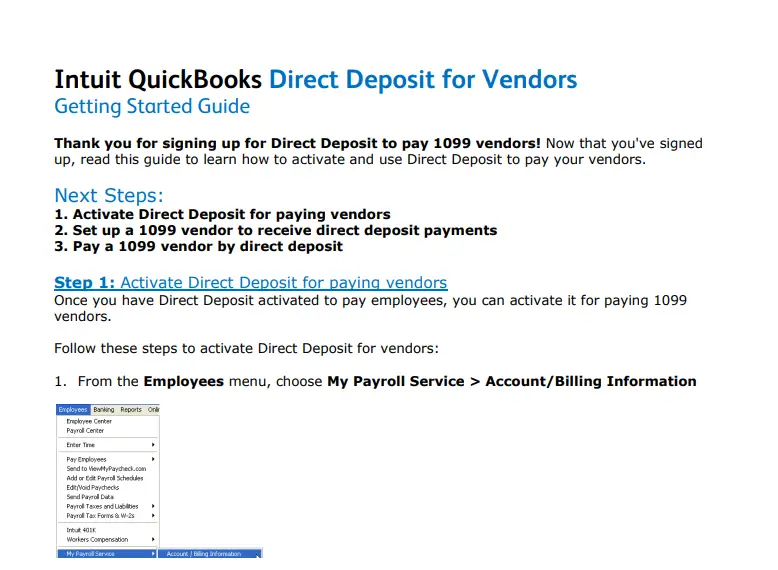

Change the bank account where payroll fees will post in QuickBooks Desktop. Change the default bank account to use when developing paychecks in QuickBooks Desktop. Go to Payroll Info section, under Di rect Deposit B ank Account select Verify. Select Employees, then My Payroll Service, then Account/Billing Information. Enter these two test debits in the Payroll Account Management Portal: You’ll see two small one-time withdrawals made by way of QuickBooks Payroll Service. Select Close on the Send/Receive Data window.Īctivate your New Direct Deposit Bank AccountĪfter one to two banking days, take a look at your bank statement. In the Account Preferences, select the new bank account from the drop-down list. On the Send/Receive Data window, select Preferences. QuickBooks Payroll Direct Deposit Authorization Form Popular News Firestick Sleep Timer How To Setup Guide On All Versions Tutorial 2021 Yoga Mudra 6. Reimbursement is basically a non-taxable payment that can be used to repay the employee for. Select Direct Deposit on your tax form (or select the direct deposit option if. QuickBooks Employee Reimbursement via Direct Deposit: Full Guide. Select Employees, then Send Payroll Data. Reload Intuit Turbo CardAvailable at thousands of participating retailers.

Now, update the account that direct deposit paychecks and fees will post to if necessary. Enter your payroll PIN then select Continue.Under Di rect Deposit B ank Account select Edit. Sign in using your Intuit Account login. Through direct deposit, the employees get their wages on the payday itself, and it also eliminates the need for storing copies of forms, files, and records of.

Select Employees, then My Payroll Service, then Accounts/Billing Information. Now, update the bank account statistics in the QuickBooks Payroll Account Management Portal. Employees who want to use direct deposit need to sign a form providing you with. Select Save & Close to save your changes. Work If you use the payroll service provided by QuickBooks. Set up and Update the Bank Accountįirst, if you haven’t set up the new bank account, do so in the QuickBooks Desktop Chart of Accounts.

Select Employees, then My Payroll Service, then Accounts/Billing Information. Now, update the bank account statistics in the QuickBooks Payroll Account Management Portal. Employees who want to use direct deposit need to sign a form providing you with. Select Save & Close to save your changes. Work If you use the payroll service provided by QuickBooks. Set up and Update the Bank Accountįirst, if you haven’t set up the new bank account, do so in the QuickBooks Desktop Chart of Accounts.

Set up and Update the Bank Account Activate your New Direct Deposit Bank Account Update Bank Account Information via Form Still Stuck? Call +1-(818) 900-9884 Chat Live to the Customer Care Executive.ĭo you want to change the bank account that your direct deposit funds are withdrawn from? We show you how.

0 kommentar(er)

0 kommentar(er)